Award-winning PDF software

Irs 8594 instructions 2025 Form: What You Should Know

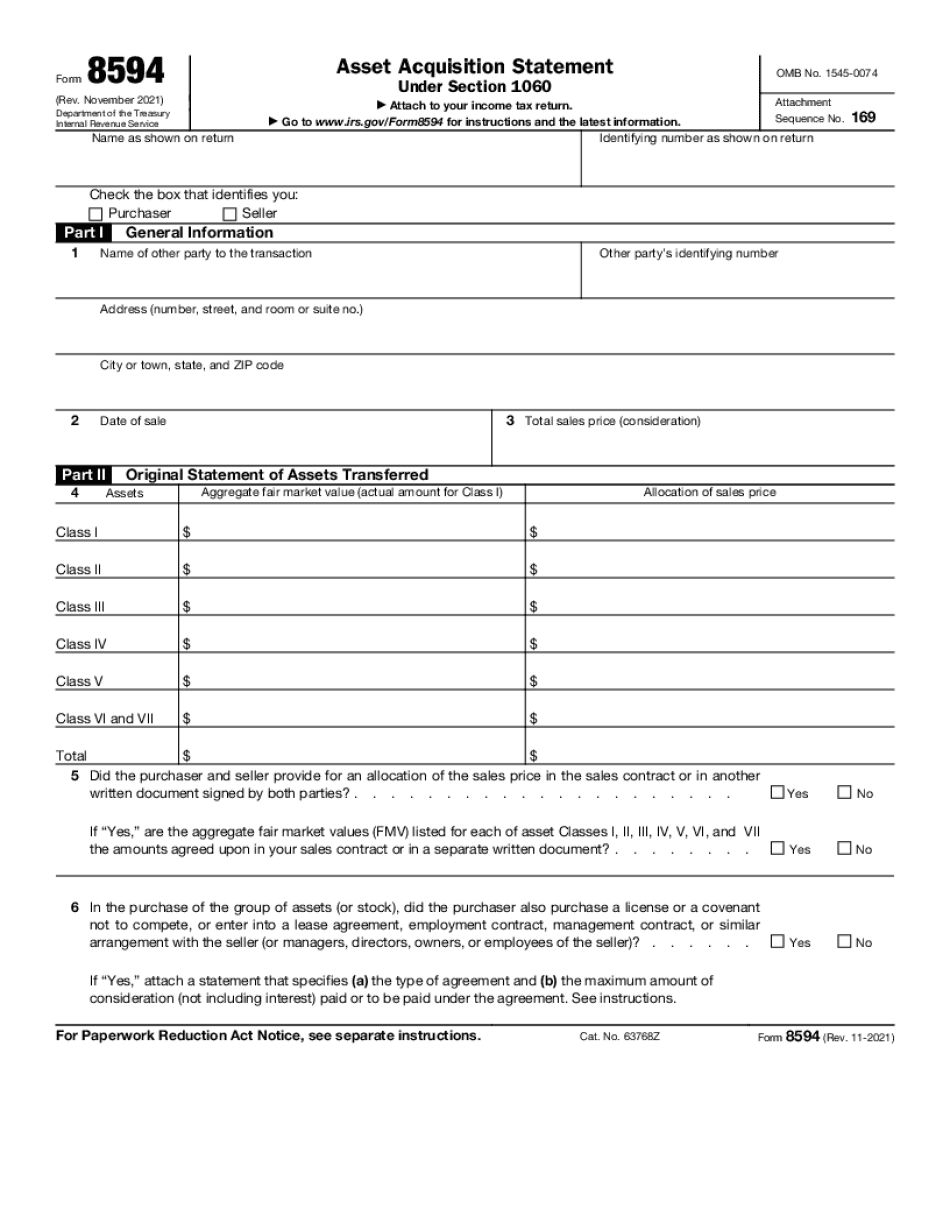

Related Forms Section: IRS General Information About the Property You Are Selling You need the Form 8594 in case the IRS asks to see the property. Form 8594 is made if you have taxable property that is more than 500,000 and more than 50 years old. Generally, any sale of a business property makes a net gain for the taxpayer. If Form 8593, Real Estate Lessee Election, is required by the salesperson, it must be completed in the same form and for the same purpose. In the case of a purchase-leaseback agreement, no election is needed. Form 8593 is for any transaction that affects the property subject to the sale. General information about the property as well as its condition — such as whether it needs work — and the seller's or the seller's agent's recommendations. Note on Form 3800 and Form 1040: If you have a real estate rental property which involves a net gain for the taxpayer, Form 1040 must be completed, with Schedule C attached. If income taxes are paid on a real estate lease in a subsequent year, Schedule C must be completed (even if there are no deductions). If property is reported on line 23 of its Schedule D, you must complete Schedule A. The information must be completed on an attached Schedule A if more than one item is required. General Information about the Sale of Real Property If the real estate is not listed for sale, then a sale-leaseback agreement needs to be completed. If the real estate has a capital leasehold interest, then a transaction statement is required. If the real estate is listed for sale, then a tax statement is required. General Advice on Your Real Estate Lease Learn how to determine whether any installment plan or purchase and sale agreement is appropriate. In most cases, if the property is more than 40 years old, you must use the annual installment method. If you make installment payments, use Form 4469 to report the payments using the method appropriate for the installment method. General Advice on Your Real Property Investments Learn the rules governing investments and the interest rates to use in making tax-free income on real property. It is important to know certain rules. This article will help you plan for real estate investment in Section 162(m) tax situations. General Information About Your Section 83 Tax Payment See Publication 551, if you qualify.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8594, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8594 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8594 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8594 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.