Award-winning PDF software

Form 8594, asset acquisition form: explained! - young & the

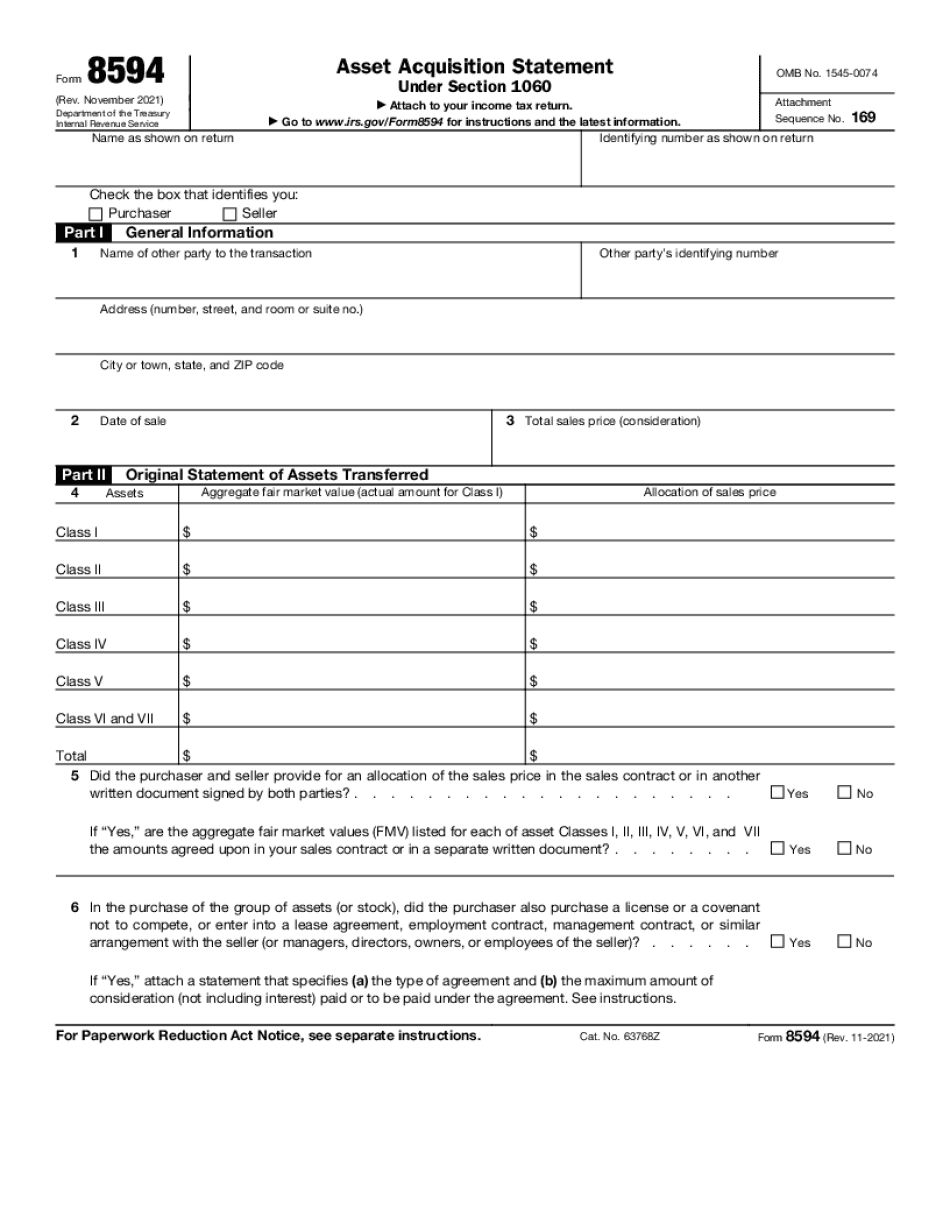

Report. If the sale was to a corporation, the transaction must be disclosed on the corporation's annual report, Form 1120. This filing is typically completed within a specific time period (known as a holding period) to indicate what has been acquired. There are three types of asset acquisitions: - A noncash “disposition” of assets, such as selling a corporation's stock. — A cash payment or loan, such as the sale of an asset to satisfy debt, to offset taxable income. — A sale, exchange, redemption, or other payment, such as the sale of an asset used in a nonqualified retirement plan. An acquisition of a business asset must typically be disclosed on the business' annual or quarterly reports. Any of the above transactions, regardless of the type, may be considered a “disposition” if, for all three of the following statements, which are deemed inapplicable only if one of the conditions is not.

Reporting the sale of a business on form 8594

If the business was not purchased or sold, the report will be signed by the Secretary of State by hand. Form 8594 also has a section where the applicant can explain the reason that the application is for a group or multiple sales. The form lists: The number of people in the group or the amount of the group's assets that is to be sold The method and total amount of sales made in order to make the group's assets eligible for tax-free status; The cost or fair market value of each group's income. It includes, but is not limited to: income from any source that isn't derived from business assets sold and income from selling business assets that were obtained within the prior two years before filing the application. Income that was obtained by a partner or a trust is not considered business.

Instructions for form 8594

A banking corporation, a depository institution or a financial institution is an institution organized and existing under the laws of a state of the United States and is subject to taxation as a corporation under the laws of that state. If it receives payments from a state, it is also subject to state taxation. A banking corporation, a depository institution or a financial institution must be, in effect, a bank, unless specifically exempted from that general description. A banking corporation, a depository institution or a financial institution may be a public utility if no more than 10 percent of its gross receipts in any financial year are derived from such activities. For more information on the income tax treatment of a banking corporation and depository institutions and certain depository institution financial institution loans, refer to Internal Revenue Services Publication 1471. A banking corporation, a depository institution, or a financial.

Form 8594 - everything you need to know | eqvista

They need to have the same last name and be married by the time they file the form. Form 8594 is a business form that is completed and filed using the correct taxpayer information and date. In this case, the date was March 22, 2014. The sellers' information had to match the information for their buyers. The buyers' information was that of the seller. Let me quickly break down the transaction. In the second month of 2014, the business had to get rid of all the inventory. The inventory was worth 10,000. That meant the seller had to sell the business in order to purchase back the inventory. That meant the buyer could not buy the remaining inventory at the current sale price since the sellers inventory was sold by the IRS by February 2014. The seller was supposed to provide a purchase price of 8,000 by the buyer. The.

Instructions for form 8594 - reginfo.gov

The purchaser has to also file Forms 8817, 9026, 9027, 1344, 1556, 1560 and 1561 as part of the tax filing. What if, after making the purchase, the purchaser finds that an error occurred? When the purchase of the property is disputed in any way, . If the transaction is not completed, and the purchaser is not aware of the error, , it is best to let the property sit until the dispute is resolved. This leaves you with a better and higher end product, but may be subject to some additional expense. A good rule of thumb is that you get what you pay for and, as long as the property is in the same condition as when you purchased it, you should not have any problems getting your original purchase price back. If you choose, however, to hold the property until resolution is reached, you should include a clause in your agreement that gives.